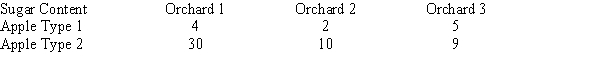

The table lists the sugar content of two types of apples from three different orchards. At  , test the claim that the sugar content of the apples and the orchard where they were grown are not related.

, test the claim that the sugar content of the apples and the orchard where they were grown are not related.

Definitions:

Regressive Tax

A tax levied in a way where the rate of taxation diminishes as the taxable amount gets larger.

Proportional Tax

A taxation system where the tax rate remains constant regardless of the amount subject to tax.

Progressive Tax

A tax system where the tax rate increases as the taxable amount or income rises, meaning higher earners pay a larger percentage of their income in taxes than lower earners.

Progressive Tax

A tax system where the tax rate increases as the taxable amount increases, meaning higher income individuals pay a larger percentage of their income in taxes compared to lower-income individuals.

Q6: Give the mean of the following probability

Q8: Given the order-requirement digraph below (with time

Q10: Compare the first-fit (FF) and first-fit decreasing

Q12: A random group of oranges were selected

Q44: A quality control supervisor selected a sample

Q49: If 30 tickets are sold and 2

Q60: A five-number summary of a data set

Q87: Find the number of bins required using

Q96: Find an Euler circuit on the graph

Q108: Find the maximum value of P, where