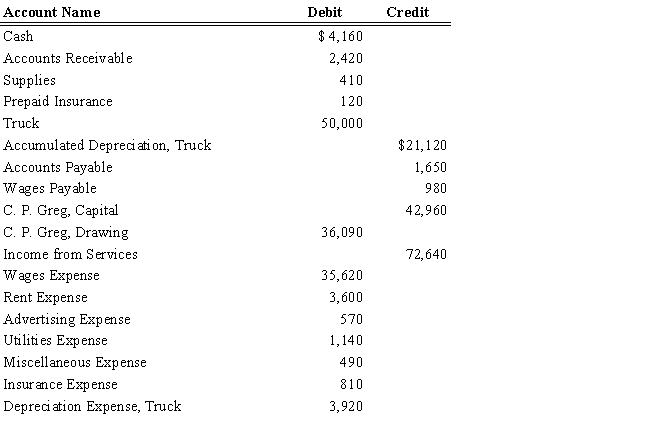

The December 31 year-end ledger balances for Quick Delivery are presented below.

Instructions:

Journalize the four closing entries in the proper order in the general journal.

Definitions:

Word Salad

A confused or unintelligible mixture of seemingly random words and phrases, typically associated with severe mental illness.

Schizophrenia

A severe mental disorder characterized by disruptions in thought processes, perceptions, emotional responsiveness, and social interactions.

Unrelated Words

A set of words that do not have any direct connection or association with each other.

Flat Affect

A severe reduction in emotional expressiveness, often characterized by a lack of facial expression or vocal tone variation.

Q15: The chart of accounts for Mira Delivery

Q17: Jones Co. takes a physical inventory count

Q24: In the general journal, all liability accounts

Q32: A book containing all the accounts of

Q48: The general ledger shows a complete record

Q49: All of the following are items that

Q56: Double-entry accounting means that, for each transaction,

Q76: The ledger of Martin Medicos contained

Q91: If the perpetual inventory system is used,

Q101: The Balance Sheet credit column of the