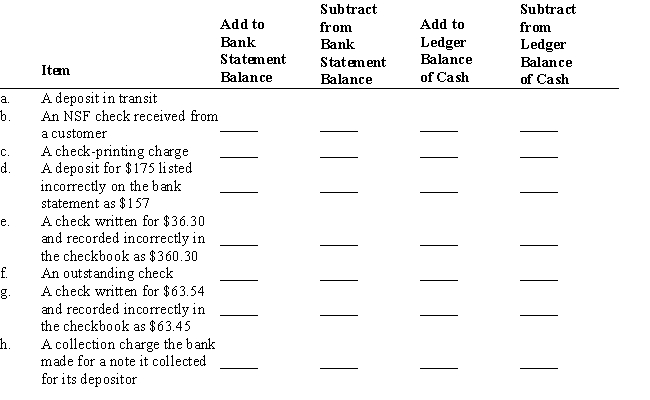

Place an X in the column that indicates the location of each item that would be found on a bank reconciliation. Assume that the checks written by the company are written correctly.

Definitions:

Premature Ejaculation

A sexual dysfunction characterized by ejaculation that always or nearly always occurs prior to or within about one minute of vaginal penetration, or, the inability to delay ejaculation on all or nearly all vaginal penetrations.

Genito-Pelvic Pain/Penetration Disorder

A sexual dysfunction characterized by significant pain during intercourse or penetration attempts, causing distress or relational difficulties.

PDE-5 Inhibitors

A class of drugs that are used to treat erectile dysfunction by enhancing the effects of nitric oxide, increasing blood flow to the penis.

Q2: Net income appears on the work sheet

Q5: Emma Parker is hired as a tailor.

Q6: Entries are made to the Petty Cash

Q26: On October 30, goods with a list

Q60: Account type and normal balance of the

Q88: Totaling each side of a T account<br>A)Trial

Q95: Assume that Sophia Co. pays its employees

Q101: Group of accounts representing the details of

Q102: An adjusting entry to record expired or

Q107: Under the accrual basis of accounting, sales