Jane's Animal Haven uses the general journal to record its charge sales invoices instead of a sales journal. The sales tax rate is 4.5 percent on retail item(s).

Instructions:

1.

Record the June 1 balances, if any, in the general ledger as given: Accounts Receivable 113 controlling account, $1,326; Sales Tax Payable 214, Sales 411, $26,852, Sales Returns and Allowances 412. Write "Balance" in the Item column and place a check mark in the Post. Ref. column.

2.

Open the following accounts in the accounts receivable ledger and record the balances, if any, as of June 1: J. Green; G. Haas, $656; S. Soudah; L. Wold. For the account having a balance, write "Balance" in the Item column and place a check mark in the Post. Ref. column.

3.

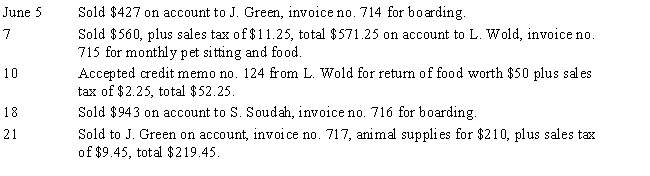

Record the below transactions in the general journal for the total amount of the charge sales invoices.

4.

Post the amounts from the general journal to the general ledger and accounts receivable ledger. Write the invoice number of each sales invoice in the Post. Ref. column to indicate that the amounts have been posted.

5.

Prepare a schedule of accounts receivable.

?

Definitions:

Irreparable

Impossible to repair, fix, or make right; typically used to describe damage or harm that is permanent or beyond restoration.

Aggravated Assault

An enhanced form of assault involving factors that raise the crime's severity, such as the use of a deadly weapon or intent to do serious harm.

Felony

A serious crime, usually punishable by imprisonment for more than one year or by death.

Misdemeanor

A criminal offense that is less serious than a felony and generally punishable by fines, sanctions, or imprisonment for less than one year.

Q24: Mike earns wages of $1,000. He increases

Q29: The Prepaid Insurance account has a balance

Q35: Under a periodic inventory system, entries are

Q45: There is no wage ceiling limit for

Q64: Cox Co. uses the cash basis of

Q83: What are reversing entries? Which adjusting entries

Q86: Account used to record the reduction in

Q86: Using T accounts, record the required adjusting

Q92: A form that summarizes payroll information for

Q99: A decrease in Sales Discounts results in