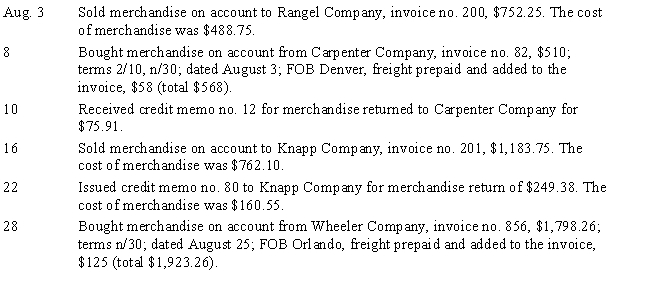

The following transactions relate to Hatfield Company, a furniture wholesaler, during August of this year. Terms of sale are 2/10, n/30. The company is located in Dallas, Texas.

Instructions:

Record the transactions in the general journal using the perpetual inventory system.

Definitions:

Deferred Tax Liability

A tax obligation that a company has incurred but is not yet required to pay, often arising from differences between accounting methods for financial statements and tax purposes.

Associate

A company in which another company owns a significant portion (usually between 20% and 50%) but not a majority stake, providing it with significant influence.

Equity Entries

Accounting transactions that affect the owners' equity account in a company's balance sheet, such as issuing stock or paying dividends.

Parent Entities

Companies that own more than half of the voting rights of another company or have control over it, making the other company a subsidiary.

Q2: A conveyor belt has a useful life

Q5: In discounting notes receivable, a financial institution

Q19: Frank Delivery Services establishes a Change Fund

Q38: Assuming Net Sales is $180,000, Cost of

Q45: Merchandise Inventory that appears in the Balance

Q61: This transfers title to the money and

Q76: The purpose of the post-closing trial balance

Q85: A Form W-3 must be submitted to

Q87: When merchandise previously sold is returned for

Q99: It is much more important to post