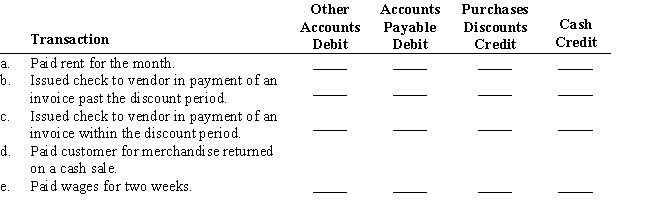

Indicate the appropriate columns in which each of the following transactions would be recorded in the cash payments journal.

Definitions:

Workplaces

The physical or virtual environments where individuals perform their job duties.

Retaliation Claim

A legal claim made by an employee when they believe they have been punished by their employer for legally protected actions like whistleblowing.

Civil Rights Act

A landmark piece of legislation in the United States that outlaws discrimination based on race, color, religion, sex, or national origin.

Investigation

The process of systematically examining and researching facts to uncover information or truth.

Q8: The following transactions were completed by Fox

Q11: Indicate the work sheet columns in which

Q26: Self-employed person<br>A)FICA taxes<br>B)Payroll register<br>C)Employer<br>D)Gross pay<br>E)Workers' compensation laws<br>F)Employee's

Q50: The terms of trade reflects the:<br>A) rate

Q52: The Unearned Revenue account normally has a

Q62: Which of the following insurance coverages is

Q65: Colin Street Body Shop has the following

Q72: The following transactions were completed by Aquamarine

Q77: When using a perpetual inventory system, a

Q84: An "X" below the total amount of