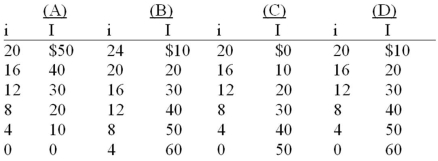

Assume that if the interest rate that businesses must pay to borrow funds were 20 percent, it would be unprofitable for businesses to invest in new machinery and equipment so that investment would be zero. But if the interest rate were 16 percent, businesses would find it profitable to invest $10 billion. If the interest rate were 12 percent, $20 billion would be invested. Assume that total investment continues to increase by $10 billion for each successive 4 percentage point decline in the interest rate.

-Refer to the above information. Using i and I to indicate the interest rate and investment (in billions of dollars) respectively, which of the following is the correct tabular presentation of the described relationship?

Definitions:

Total Cost

The complete cost of producing a specific quantity of goods or services, including both fixed and variable costs.

Average Cost

This is the total cost of production divided by the number of goods produced, also known as the cost per unit.

Copyright

A legal right granted to the creator of an original work, providing exclusive control over the work's use and distribution.

Q6: A set of values for the decision

Q10: Refer to the above table. For these

Q18: A hospital needs to determine how many

Q23: Households and businesses are both suppliers in

Q41: How could a network be modified if

Q52: A hospital needs to determine how many

Q54: Property rights are important because they:<br>A) encourage

Q56: In response to an unexpected change in

Q211: The above data suggest that:<br>A) consumption varies

Q248: In drawing a budget line it is