Exhibit 3.4

The following questions are based on this problem and accompanying Excel windows.

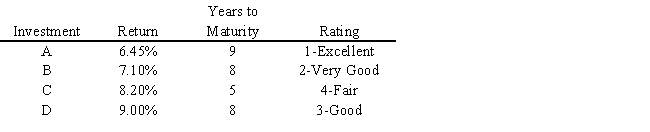

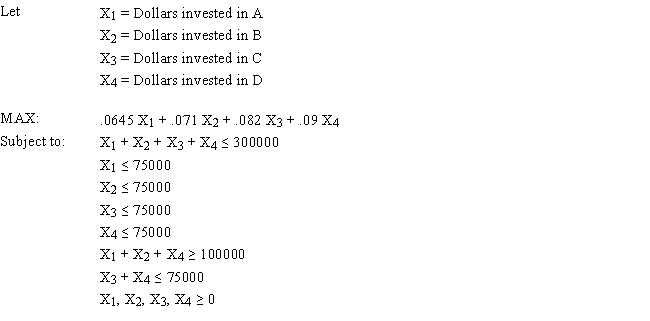

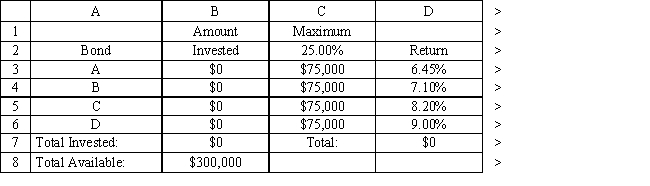

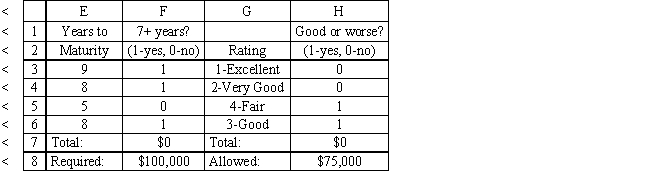

A financial planner wants to design a portfolio of investments for a client. The client has $300,000 to invest and the planner has identified four investment options for the money. The following requirements have been placed on the planner. No more than 25% of the money in any one investment, at least one third should be invested in long-term bonds which mature in seven or more years, and no more than 25% of the total money should be invested in C or D since they are riskier investments. The planner has developed the following LP model based on the data in this table and the requirements of the client. The objective is to maximize the total return of the portfolio.

-Refer to Exhibit 3.4. What formula should be entered in cell D7 in the accompanying Excel spreadsheet to compute the total return?

Definitions:

Widgets

A generic term used to refer to a hypothetical manufactured product or any small device or gadget.

Fixed Costs

Expenses that do not change with the volume of production or sales, such as rent, salaries, and insurance.

Opportunity Costs

The value of the next best alternative foregone as a result of making a decision.

Production Capacity

The maximum amount of goods or services a facility can produce over a given period under normal working conditions.

Q7: A company needs to hire workers to

Q10: A small town wants to build some

Q11: Project 5.2 − Small Production Planning Project<br>(Fixed

Q19: A manufacturing company has a pool of

Q33: The feasible region for the pure ILP

Q46: You have been given the following linear

Q49: A company wants to locate a new

Q52: The d<sub>i</sub><sup>+</sup>, d<sub>i</sub>− variables are referred to

Q94: The concept of a lower bound in

Q187: The term "other things equal" means that:<br>A)