Exhibit 3.4

The following questions are based on this problem and accompanying Excel windows.

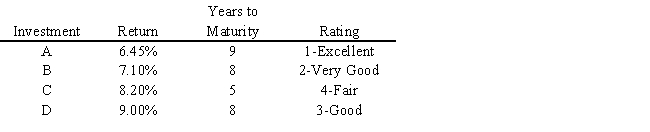

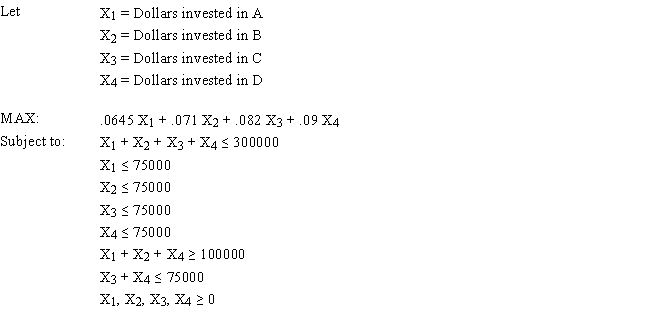

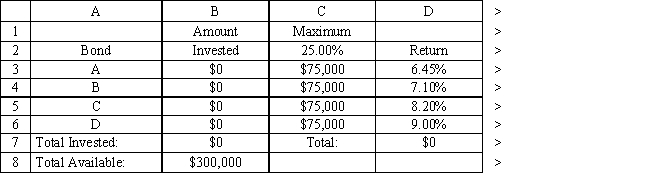

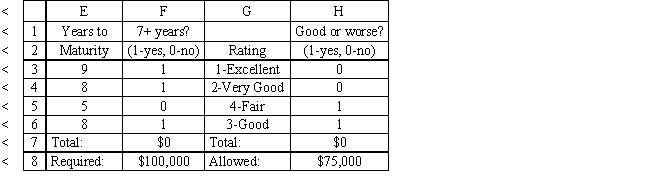

A financial planner wants to design a portfolio of investments for a client. The client has $300,000 to invest and the planner has identified four investment options for the money. The following requirements have been placed on the planner. No more than 25% of the money in any one investment, at least one third should be invested in long-term bonds which mature in seven or more years, and no more than 25% of the total money should be invested in C or D since they are riskier investments. The planner has developed the following LP model based on the data in this table and the requirements of the client. The objective is to maximize the total return of the portfolio.

-Refer to Exhibit 3.4. Which cells are changing cells in the accompanying Excel spreadsheet?

Definitions:

Milgram Experiment

A psychological experiment conducted by Stanley Milgram in the 1960s to study obedience to authority, where participants were instructed to administer electric shocks to another person.

Stanford University Prison Experiment

A psychological study conducted by Philip Zimbardo in 1971 at Stanford University, where students were assigned roles of prisoners and guards to explore the effects of perceived power.

Generalization

Drawing a conclusion about a certain characteristic of a population based on a sample from it.

Logical Support

The provision of reasons or evidence to justify a claim or argument.

Q11: The R<sup>2</sup> statistic (also referred to

Q47: Refer to the above graph. Which of

Q48: A company is developing its weekly production

Q53: In drawing the production possibilities curve we

Q57: A company wants to locate a new

Q64: In the GRG algorithm the initial solution

Q71: Macroeconomics approaches the study of economics from

Q73: The simplex method of linear programming (LP):<br>A)

Q147: The society must also make choices under

Q210: In the above diagram the vertical intercept