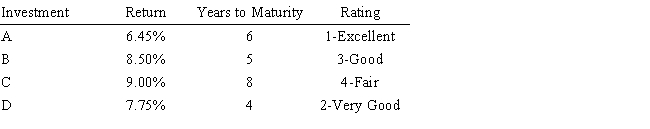

A financial planner wants to design a portfolio of investments for a client. The client has $400,000 to invest and the planner has identified four investment options for the money. The following requirements have been placed on the planner. No more than 30% of the money in any one investment, at least one half should be invested in long-term bonds which mature in six or more years, and no more than 40% of the total money should be invested in B or C since they are riskier investments. The planner has developed the following LP model based on the data in this table and the requirements of the client. The objective is to maximize the total return of the portfolio.

Formulate the LP for this problem.

Definitions:

Type A Personality

Type A Personality is characterized by traits such as high competitiveness, self-imposed stress, impatience, and a sense of urgency, often linked to a higher risk of heart disease.

Type B Personality

A personality type characterized by a relaxed, less competitive approach to life, as opposed to the more stressed and goal-oriented Type A personality.

Cardiovascular Disease

A class of diseases that involve the heart or blood vessels, including coronary artery disease, hypertension, heart failure, and others.

Regular Exercise

A routine of physical activity that is maintained over time to improve or maintain one's physical fitness, health, and well-being.

Q5: Is the optimal solution to this problem

Q13: How much are additional units of labor

Q16: What is the objective function in the

Q17: The third step in formulating a linear

Q19: The objective function value for the optimal

Q22: Given the following Analytic Solver Platform sensitivity

Q36: In NLP a local optimum is best

Q42: The goal of the modeling approach to

Q69: A sub-problem in a B & B

Q81: A soft constraint<br>A) represents a target a