Project 5.2 − Small Production Planning Project

(Fixed Charge Problem via Network Flow with Side Constraints)

Jack Small Enterprises runs two factories in Ohio, one in Toledo and one in Centerville. His factories produce a variety of products. Two of his product lines are polished wood clocks which he adorns with a regional theme. Naturally, clocks popular in the southwest are not as popular in the northeast, and vice versa. Each plant makes both of the clocks. These clocks are shipped to St Louis for distribution to the southeast and western states and to Pittsburgh for distribution to the south and northeast.

Jack is considering streamlining his plants by removing certain production lines from certain plants. Among his options is potentially eliminating the clock production line at either the Toledo or the Centerville plant. Each plant carries a fixed operating cost for setting up the line and a unit production cost, both in terms of money and factory worker hours. This information is summarized in the table below.

Production Cost

Clocks Produced

per Clock

per Hour

Available

Plant

Fixed Cost for

Southwest

Northeast

Southwest

Northwest

Hours per

Line

Clock

Clock

Clock

Clock

Month

Toledo

$20,000

$10

$12

5

6

500

Centerville

$24,000

$9

$13

5.5

6.2

675

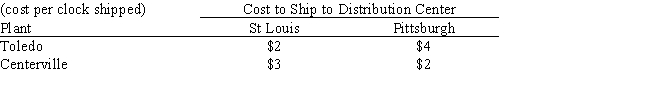

The Southwest clocks are sold for $23 each and the Northwest clocks are sold for $25 each. Demand rates used for production planning are 1875 Southwest clocks for sale out of the St Louis distribution center and 2000 Northeast clocks for sale out of the Pittsburgh distribution center. Assume all these units are sold. The per clock transportation costs from plant to distribution center is given in the following table.  Develop a generalized network flow model for this problem and implement this model in solver. Use the model to answer the following questions.

Develop a generalized network flow model for this problem and implement this model in solver. Use the model to answer the following questions.

a.

Should any of the production lines be shut down?

b.

How should worker hours be allocated to produce the clocks to meet the demand forecasts? Are there any excess hours, and if so how many?

c.

What is the expected monthly profit?

d.

If a plant is closed, what are the estimated monthly savings?

Definitions:

Control Over Price

The ability of a person or organization to influence the price at which goods or services are sold.

Contestable Market

A market structure where there are no barriers to entry or exit, ensuring that prices remain competitive even in the absence of a large number of sellers.

Minimum-cost Production

A principle in economics where goods and services are produced at the lowest possible cost, maximizing efficiency and resource use.

Normal Profit Rate

Zero economic profit, providing just the competitive rate of return on the capital (and labor) of owners. An above-normal profit will draw more entry into the market, whereas a below-normal profit will lead to an exit of investors and capital.

Q4: The allowable decrease for a constraint is<br>A)

Q8: To illustrate how a complex system will

Q15: The present choice of position on the

Q29: A company needs to ship 100 units

Q33: The feasible region for the pure ILP

Q48: A company is developing its weekly production

Q54: Goal Programming and Multiple Objective Optimization are

Q56: The estimated value of Y<sub>1</sub> is given

Q89: Bounds on the decision variables are known

Q112: Products and services are scarce because resources