Exhibit 6.1

The following questions pertain to the problem, formulation, and spreadsheet implementation below.

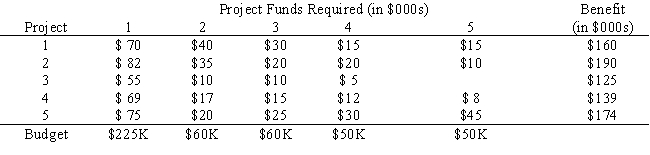

A research director must pick a subset of research projects to fund over the next five years. He has five candidate projects, not all of which cover the entire five-year period. Although the director has limited funds in each of the next five years, he can carry over unspent research funds into the next year. Additionally, up to $30K can be carried out of the five-year planning period. The following table summarizes the projects and budget available to the research director.  The following is the ILP formulation and a spreadsheet model for the problem.

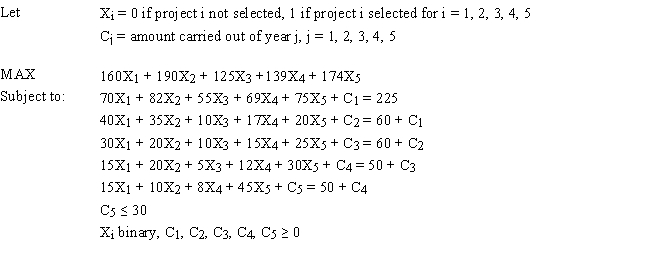

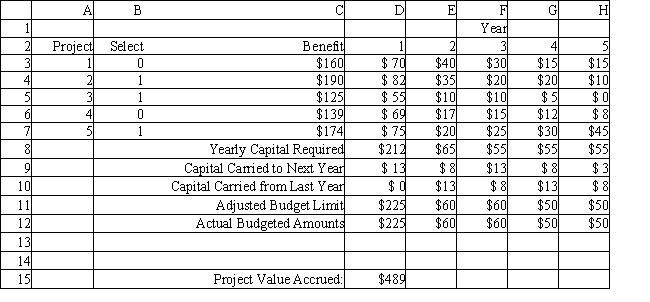

The following is the ILP formulation and a spreadsheet model for the problem.

-Refer to Exhibit 6.1. What values would you enter in the Analytic Solver Platform task pane for the above Excel spreadsheet?

Objective Cell:

Variables Cells:

Constraints Cells:

Definitions:

Resistance

Opposition against an influence, policy, or authority, often expressed through actions or behaviors aimed at countering or challenging it.

Higher Status

Refers to a position of greater authority, respect, or social standing within a hierarchy.

Provine's Study

An investigation into the social and psychological aspects of laughter, examining its causes, effects, and social functions.

Laughs

Vocal sounds expressing amusement, joy, or derision, often involuntary and occurring during moments of happiness or comic relief.

Q22: Refer to Exhibit 8.2. What formula would

Q23: To be effective, a modeler must<br>A) be

Q29: What is the correct range for R<sup>2</sup>

Q58: An oil company wants to create lube

Q59: A company wants to locate a new

Q69: Why do we study the graphical method

Q74: MINIMAX solutions to multi-objective linear programming (MOLP)

Q75: Which of the following are true regarding

Q77: Residuals are assumed to be<br>A) dependent, uniformly

Q89: Bounds on the decision variables are known