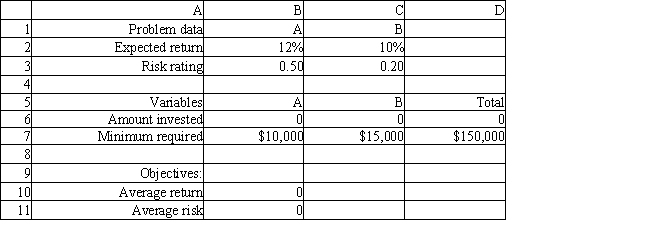

Exhibit 7.2

The following questions are based on the problem below.

An investor has $150,000 to invest in investments A and B. Investment A requires a $10,000 minimum investment, pays a return of 12% and has a risk factor of .50. Investment B requires a $15,000 minimum investment, pays a return of 10% and has a risk factor of .20. The investor wants to maximize the return while minimizing the risk of the portfolio. The following multi-objective linear programming (MOLP) has been solved in Excel.

-Refer to Exhibit 7.2. What Analytic Solver Platform constraint involves cells $B$6:$C$6?

Definitions:

Accommodation Surety

A guarantor who agrees to be responsible for someone else's debt or obligation without receiving any benefit.

Bonding Company

A company that provides financial assurance to a third party through a bond, guaranteeing the performance of an individual's or company's obligations.

Right of Reimbursement

The legal right to be compensated or repaid for costs, expenses, or losses that have been incurred on behalf of another party or as a result of certain conditions being met.

Promissory Note

A financial instrument or written promise in which one party agrees to pay a specified sum of money to another party under set conditions.

Q16: Which of the following is not a

Q20: Rounding the LP relaxation solution up or

Q28: A number of practical decision problems in

Q29: The GRG algorithm terminates when it<br>A) has

Q33: Supply quantities for supply nodes in a

Q38: Given the following Analytic Solver Platform sensitivity

Q43: An office supply company is attempting to

Q52: A hospital needs to determine how many

Q67: Suppose that the correlation coefficient between X<sub>1</sub>

Q122: Refer to Exhibit 10.5. What formulas should