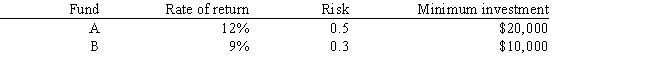

An investor wants to invest $50,000 in two mutual funds, A and B. The rates of return, risks and minimum investment requirements for each fund are:  Note that a low Risk rating means a less risky investment. The investor can invest to maximize the expected rate of return or minimize risk. Any money beyond the minimum investment requirements can be invested in either fund.

Note that a low Risk rating means a less risky investment. The investor can invest to maximize the expected rate of return or minimize risk. Any money beyond the minimum investment requirements can be invested in either fund.

Formulate the MOLP for this investor.

Definitions:

Stock Traded

The buying and selling of company shares or equity securities in financial markets.

Stockholders' Equity

The residual interest in the assets of a corporation after deducting liabilities, represented in part by capital stock and retained earnings.

Unissued Stock

Unissued stock refers to shares that have been authorized in a company's charter but have not yet been sold or distributed to shareholders.

Shares

Units of ownership interest in a corporation or financial asset that provide for an equal distribution in any profits, if any are declared, in the form of dividends.

Q5: In a network flow problem, the value

Q18: What is missing from transportation problems compared

Q23: Any shortest path problem can be modeled

Q38: Methods for analyzing risk that are discussed

Q43: When the objective function can increase without

Q46: Suppose that environmental and human variables are

Q48: Refer to Exhibit 11.12. What Excel command

Q60: Refer to Exhibit 7.3. What formula goes

Q66: The following network depicts a balanced assignment/transportation

Q70: Jones Furniture Company produces beds and desks