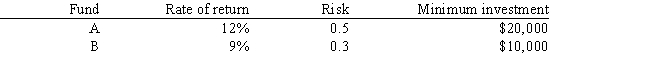

An investor wants to invest $50,000 in two mutual funds, A and B. The rates of return, risks and minimum investment requirements for each fund are:  Note that a low Risk rating means a less risky investment. The investor wants to maximize the expected rate of return while minimizing his risk. Any money beyond the minimum investment requirements can be invested in either fund. The investor has found that the maximum possible expected rate of return is 11.4% and the minimum possible risk is 0.32.

Note that a low Risk rating means a less risky investment. The investor wants to maximize the expected rate of return while minimizing his risk. Any money beyond the minimum investment requirements can be invested in either fund. The investor has found that the maximum possible expected rate of return is 11.4% and the minimum possible risk is 0.32.

Formulate a goal programming model with a MINIMAX objective function.

Definitions:

Glass-Steagall Act

A U.S. law enacted in 1933, which separated commercial banking from investment banking, repealed in 1999.

1999 Repeal

Refers to the revocation of a law or act; often mentioned in economic contexts, such as the repeal of financial regulations or acts in 1999.

Financial Crisis

A situation where the value of financial institutions or assets drops rapidly, leading to a loss of wealth, reduced access to credit, and, in some cases, bank failures.

Central Banks

Institutions that manage the currency, money supply, and interest rates of a state or country.

Q10: Refer to Exhibit 9.7. What is the

Q17: The GRG and Simplex algorithms are similar

Q27: One useful feature of Analytic Solver Platform

Q29: Overfitting refers to<br>A) placing too much emphasis

Q37: Refer to Exhibit 11.6. What are predicted

Q37: Refer to Exhibit 6.1. What values would

Q50: Consider the formulation below. The standard form

Q57: The constraints of an LP model define

Q57: A MINIMAX objective function in goal programming

Q66: Suppose that all observations in partition j