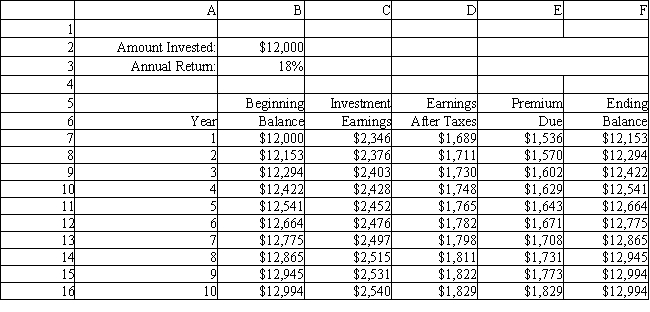

An investor wants to determine how much interest he must earn to be able to make the payments on a 10-year mortgage which has increasing annual payments. The problem is summarized in the accompanying spreadsheet. The investor has enough money to make an initial investment of $12,000 and hopes he can earn 18% on his investments. He would like to know how low his annual return can be and still allow him to make his payments from interest income.

What formulas should go in cells B7:F7 of the spreadsheet for this problem?

Definitions:

Efficient Frontier

A concept in modern portfolio theory representing the set of optimal portfolios that offer the highest expected return for a defined level of risk or the lowest risk for a given level of expected return.

Standard Deviation

A statistic that measures the dispersion of a dataset relative to its mean and is used as a measure of volatility.

Expected Return

The predicted yield or gains an investor anticipates on an investment, based on historical or statistical measures.

Efficient Frontier

A concept in modern portfolio theory representing a set of optimal investment portfolios that offer the highest expected return for a defined level of risk.

Q23: Any shortest path problem can be modeled

Q42: A cellular phone company wants to locate

Q52: The d<sub>i</sub><sup>+</sup>, d<sub>i</sub>− variables are referred to

Q69: The allowable decrease for a changing cell

Q71: Specifying suboptimality tolerances can be useful if

Q74: Robert Hope received a welcome surprise in

Q82: Refer to Exhibit 9.3. Test the significance

Q82: Refer to Exhibit 3.2. What formula should

Q90: You have been given the following linear

Q106: Refer to Exhibit 11.23. Based on the