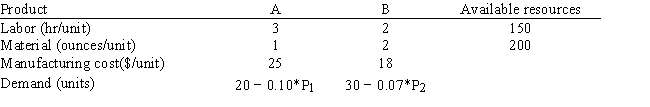

A company makes products A and B from 2 resources, labor and material. The company wants to determine the selling price which will maximize profits. A unit of product A costs 25 to make and demand is estimated to be 20 − .10 * Price of A. A unit of product B costs 18 to make and demand is estimated to be 30 − .07 * Price of B. The utilization of labor and materials and the available quantity of resources is shown in the table. A reasonable price for the products is between 100 and 200.  Let X1 = demand for As and X2 = demand for Bs. Let P1 = price for As and P2 = price for Bs.

Let X1 = demand for As and X2 = demand for Bs. Let P1 = price for As and P2 = price for Bs.

The objective function for this problem is?

Definitions:

Unrealized Holding

A profit or loss that arises from the change in value of an investment that has not yet been sold or realized.

Trading Securities

Financial instruments such as stocks and bonds that are bought and sold for the purpose of generating profits on short-term fluctuations in their prices.

Held-to-Maturity Securities

Held-to-maturity securities are debt securities that an investor intends and is able to hold until their maturity date, recorded at amortized cost.

Q12: The "triple bottom line" incorporates multiple objective

Q21: The problem of finding the optimal values

Q32: Goal programming (GP) is:<br>A) iterative<br>B) inaccurate<br>C) static<br>D)

Q34: What function should be used for generating

Q46: One way to improve performance of a

Q49: _ and _ must be chosen each

Q52: The d<sub>i</sub><sup>+</sup>, d<sub>i</sub>− variables are referred to

Q65: Refer to Exhibit 3.1. Which of the

Q78: Refer to Exhibit 11.5. What are predicted

Q97: One way to find an optimal solution