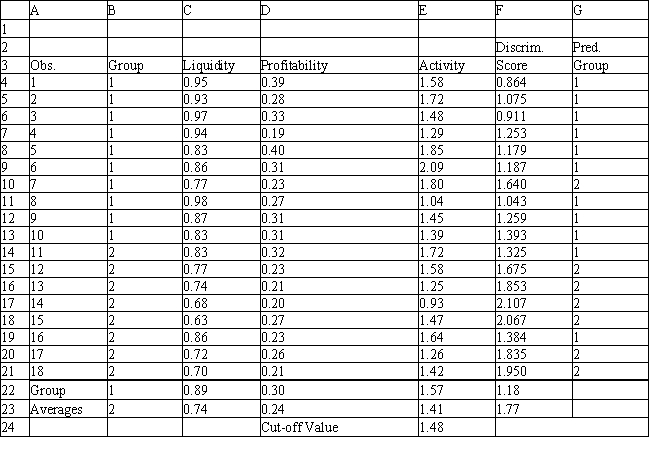

Exhibit 10.6

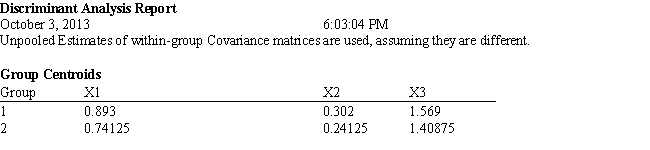

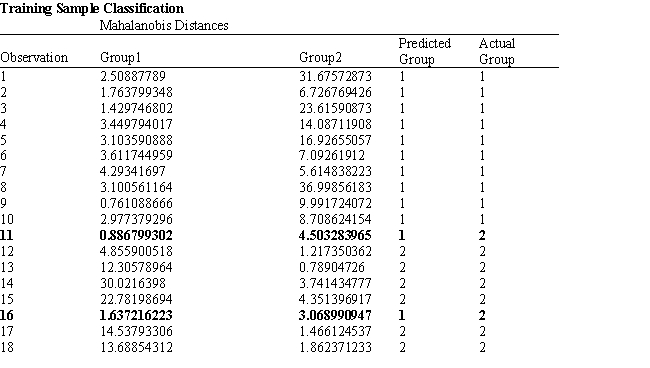

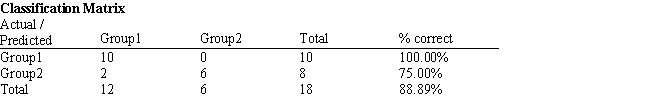

The information below is used for the following questions.

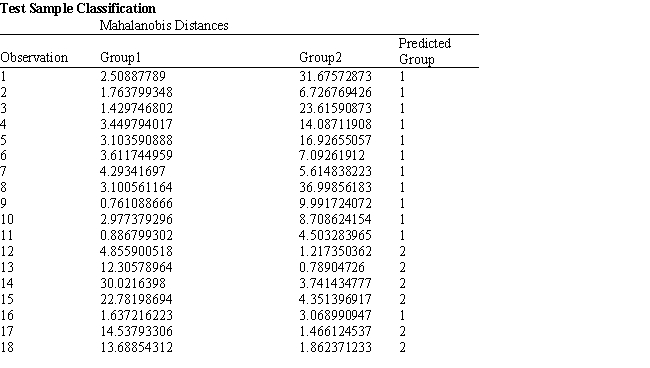

An investor wants to classify companies as being either a good investment, Group 1, or a poor investment, Group 2. He has gathered Liquidity, Profitability and Activity data on 18 companies he has invested in and run a regression analysis. Discriminant Analysis output has also been generated. The data for the problem and the relevant output are shown below.

-Refer to Exhibit 10.6. Compute the discriminant score and predicted group for a company with Liquidity = 0.80, Profitability = 0.27 and Activity = 1.55.

Definitions:

Specific Date

A particular day specified for an event or deadline, clearly identified by a combination of day, month, and year.

Public Law 95-109

The Fair Debt Collection Practices Act of 1977, a United States federal law that limits the behavior and actions of third-party debt collectors attempting to collect debts on behalf of another person or entity.

Fair Debt Collection Practices Act

A federal law in the United States that limits the behavior and actions of third-party debt collectors attempting to collect debts on behalf of another person or entity.

Unpaid Debts

Financial obligations that have not been settled or paid by the due date.

Q4: Sal, from Exhibit 12.5, has produced the

Q4: Refer to Exhibit 14.9. What formula should

Q8: What is the straight line (Euclidean) distance

Q23: Refer to Exhibit 11.11. What formula should

Q23: A vendor offers 5 different prices per

Q43: Hard constraints can be violated, if necessary

Q74: The main difference between CPM and PERT

Q101: Refer to Exhibit 11.24. Based on the

Q109: An investor is considering 2 investments, A,

Q114: Suppose that the correlation coefficient between X<sub>1</sub>