Exhibit 10.6

The information below is used for the following questions.

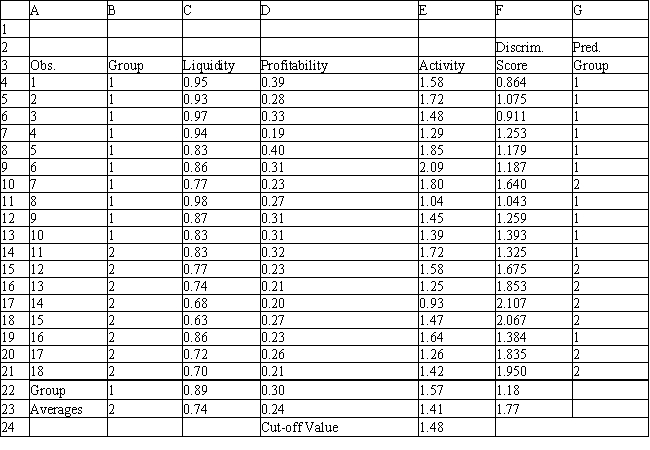

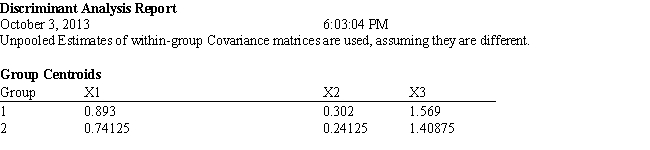

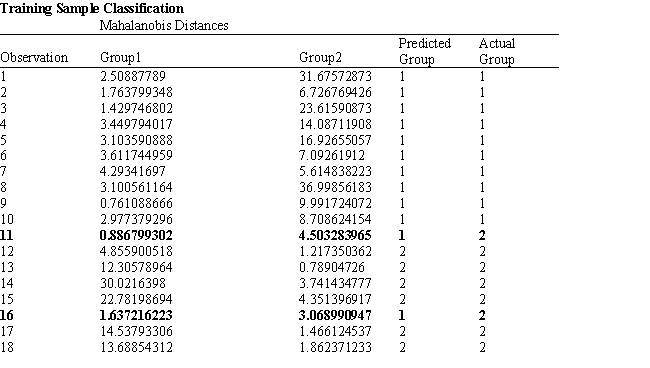

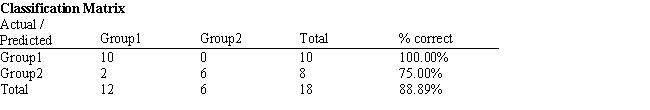

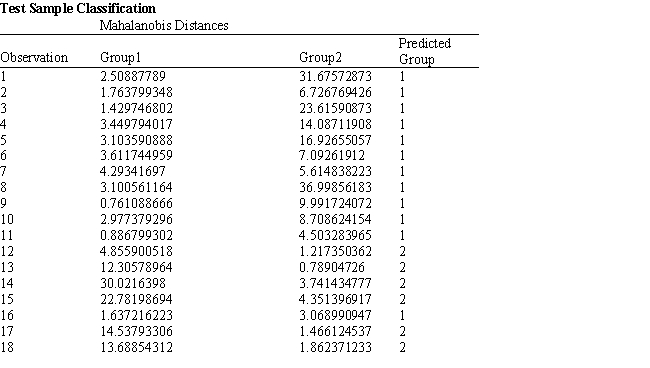

An investor wants to classify companies as being either a good investment, Group 1, or a poor investment, Group 2. He has gathered Liquidity, Profitability and Activity data on 18 companies he has invested in and run a regression analysis. Discriminant Analysis output has also been generated. The data for the problem and the relevant output are shown below.

-Refer to Exhibit 10.6. What formulas should go in cells C22:D23, E4:G24, and F24 of the spreadsheet?

Definitions:

Investing Activities

Refers to the acquisition and disposition of long-term assets and other investments not included in cash equivalents.

Free Cash Flow

The amount of operating cash flow available to a company after it purchases the property, plant, and equipment necessary to maintain its current operations, computed as cash flows from operating activities less cash used to purchase property, plant, and equipment.

Operating Cash Flow

Cash generated from the core business operations of a company, excluding financing and investment activities.

Direct Method

In cash flow reporting, it involves directly identifying and reporting major classes of gross cash receipts and payments.

Q8: Refer to Exhibit 14.5. What is the

Q23: A vendor offers 5 different prices per

Q47: How many local maximum solutions are there

Q56: The estimated value of Y<sub>1</sub> is given

Q65: An investor wants to determine how much

Q76: Refer to Exhibit 10.4. Compute the discriminant

Q78: An oil company wants to create lube

Q88: Consider the constraint <br>X<sub>3</sub> + X<sub>4</sub> +

Q91: Refer to Exhibit 10.6. What formulas should

Q114: Suppose that the correlation coefficient between X<sub>1</sub>