Exhibit 12.3

The following questions use the information below.

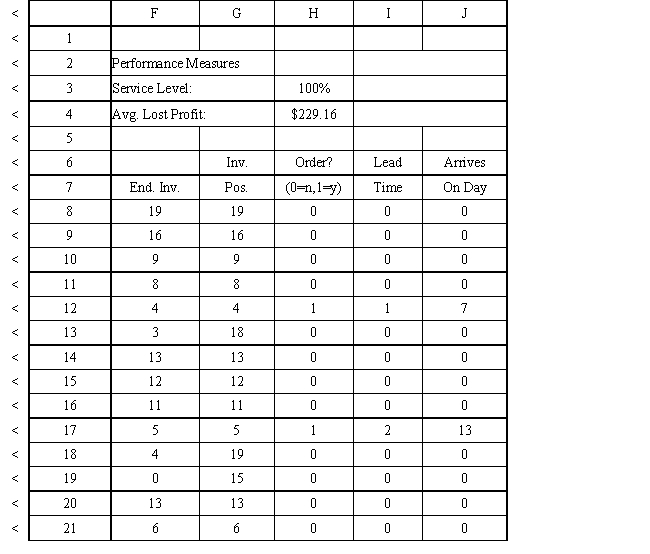

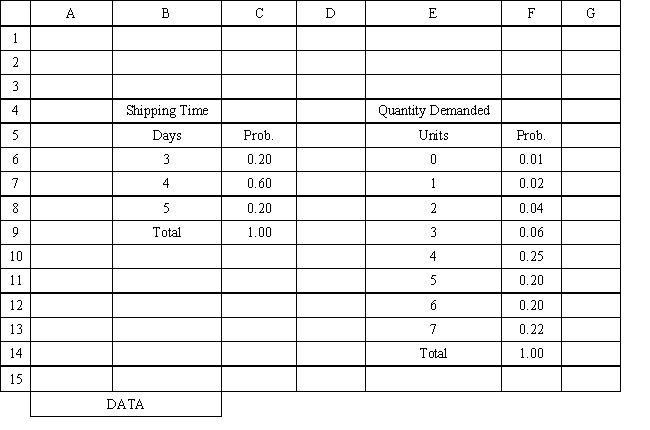

An auto parts store wants to simulate its inventory system for engine oil. The company has collected data on the shipping time for oil and the daily demand for cases of oil. A case of oil generates a $10 profit. Customers can buy oil at any auto parts store so there are no backorders (the company loses the sale and profit) . The company orders 30 cases whenever the inventory position falls below the reorder point of 15 cases. Orders are placed at the beginning of the day and delivered at the beginning of the day so the oil is available on the arrival day. An average service level of 99% is desired. The following spreadsheets have been developed for this problem. The company has simulated 2 weeks of operation for their inventory system. The current level of on-hand inventory is 25 units and no orders are pending.

-The average demand is 4.45 cases per day. Using the information in Exhibit 12.3, what formula should go in cell H4 to determine the average lost sales?

Definitions:

Hourly Fees

Charges applied based on the amount of time spent on a task or service, usually quantified in hours.

Chronological Order

The arrangement of events or actions in the order that they occurred in time.

Contingency Fee

A payment structure where a lawyer only gets paid if the case is won, typically a percentage of the settlement or award.

Cloud-based Computing

A technology that allows individuals and companies to access software, storage, and other computing services over the Internet, rather than through local servers or personal devices.

Q10: A company wants to locate a new

Q11: A NLP problem can have nonlinear objective

Q11: Refer to Exhibit 15.3. Draw the CPM

Q27: Refer to Exhibit 9.2. Interpret the meaning

Q33: Spontaneous acts of revenge were common responses

Q54: Noncritical activities have some negative amount of

Q65: Regression analysis is a modeling technique<br>A) that

Q74: Steps in the data mining process include

Q92: The criteria in a decision problem represent

Q112: Refer to Exhibit 14.2. What formula should