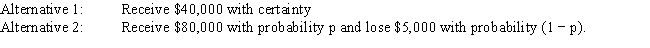

Exhibit 14.12

The following questions use the information below.

A decision maker is faced with two alternatives.  The decision maker has determined that she is indifferent between the two alternatives when p = 0.7.

The decision maker has determined that she is indifferent between the two alternatives when p = 0.7.

-Refer to Exhibit 14.12. What is the expected value of Alternative 2 for this decision maker?

Definitions:

CAPM

The Capital Asset Pricing Model is a formula that describes the relationship between the expected return of an investment and its risk, used to estimate a security's expected return based on its beta and the market's expected return.

Market Capitalization Rate

The Market Capitalization Rate refers to the expected rate of return on an investment or project, derived from the market price of a company's shares.

Risk-Free Rate

The theoretical rate of return of an investment with zero risk, helping in the calculation of the risk premium of various assets.

Expected Return

The calculated average of the possible returns for an investment, weighted by the likelihood of each outcome.

Q13: Most people think of rehabilitation first when

Q27: Taxi drivers and chauffeurs suffer the highest

Q27: The term intimate partner violence includes those

Q35: Punishment in the form of imprisonment has

Q35: Refer to Exhibit 11.9. Which column in

Q57: Refer to Exhibit 11.10. What Excel command

Q58: The objective of classification tree algorithms is

Q71: Joe's Copy Center has 10 copiers. They

Q78: If we are employing Activity-On-Node (AON) network

Q114: Probabilistic decision rules can be used if