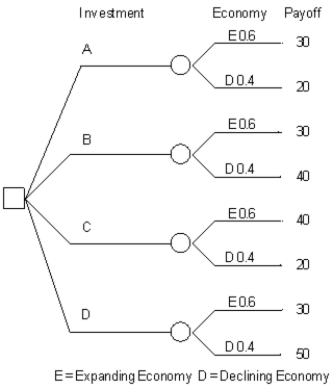

Exhibit 14.5

The following questions are based on the information below.

An investor is considering 4 investments, A, B, C, D. The payoff from each investment is a function of the economic climate over the next 2 years. The economy can expand or decline. The following decision tree has been developed for the problem. The investor has estimated the probability of a declining economy at 40% and an expanding economy at 60%.

-Refer to Exhibit 14.5. What is the expected monetary value for the investor's problem?

Definitions:

Comprehensive Income

A measure of all changes in equity of a business that result from recognized transactions and events, including unrealized gains and losses.

Stockholders' Equity

The residual interest in the assets of a corporation after deducting liabilities, representing ownership interest in the company.

Convertible Bonds

Bonds that can be converted into a predetermined number of a company's shares at certain times during its life, usually at the discretion of the bondholder.

Earnings Per Share

A financial ratio calculated by dividing a company's net income by its number of outstanding shares, indicating the profitability on a per-share basis.

Q10: During the 1990s, the rates of all

Q11: Victims' rights gained at the expense of

Q14: In an exponential smoothing method, weights are

Q20: The earliest community service program was set

Q22: In order for an incident of stalking

Q27: The benefit(s) of simulation discussed in the

Q33: Neural networks classification methodology<br>A) is one of

Q36: Using the information in Exhibit 12.5 and

Q42: In the years following the American Revolution,

Q76: Using the information in Exhibit 12.3, what