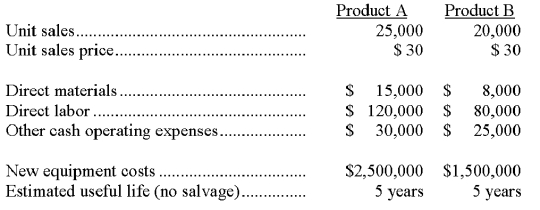

A company is trying to decide which of two new product lines to introduce in the coming year. The company requires a 12% return on investment. The predicted revenue and cost data for each product line follows:  The company has a 30% tax rate and it uses the straight-line depreciation method. The present value of an annuity of 1 for 5 years at 12% is 3.6048. Compute the net present value for each piece of equipment under each of the two product lines. Which, if either of these two investments is acceptable?

The company has a 30% tax rate and it uses the straight-line depreciation method. The present value of an annuity of 1 for 5 years at 12% is 3.6048. Compute the net present value for each piece of equipment under each of the two product lines. Which, if either of these two investments is acceptable?

Definitions:

U.S. Net Capital Outflow

The difference between the purchase of foreign assets by U.S. citizens and the purchase of U.S. assets by foreigners, reflecting the flow of capital from and into the U.S.

U.S. Saving

The portion of income that individuals, businesses, and the government in the United States set aside rather than spending it immediately.

National Saving

The sum of private and public savings in a country, representing the total income remaining after expenditures on goods and services.

Domestic Investment

The total investment in physical assets such as buildings and machinery within a country's borders.

Q4: Sensationalism refers to how _.<br>A) politicians base

Q8: The equivalent group explanation holds that crime

Q23: A company is planning to purchase a

Q46: DT Co. produces picture frames. It takes

Q48: The National Incident Based Reporting System (NIBRS)

Q65: Cabot Company collected the following data regarding

Q124: Pantheon Company has prepared the following forecasts

Q148: Adams, Inc. uses the following standard to

Q169: Cost variances are ignored under management by

Q178: As the level of output activity increases,