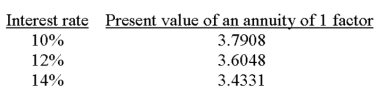

A company is considering a 5-year project. It plans to invest $60,000 now and it forecasts cash flows for each year of $16,200. The company requires a hurdle rate of 12%. Calculate the internal rate of return to determine whether it should accept this project. Selected factors for a present value of an annuity of 1 for five years are shown below:

Definitions:

Hearsay

Testimony that is given in court by a witness who relates not what he or she knows personally, but what others have said, and that is therefore generally not admissible as evidence.

Irrelevant Evidence

Evidence in a legal proceeding that is not directly related to the case at hand, making it inappropriate for consideration during the decision-making process.

Circumstantial Evidence

Evidence that indirectly proves a fact through an inference, as opposed to direct observation or testimony.

Direct Evidence

Evidence that directly proves a fact without needing any inference or presumption, such as eyewitness testimony.

Q23: When a household is selected for participation

Q32: In the United States, the peak years

Q35: Sherman Company can sell all of its

Q36: Nano, Inc. is preparing its budget for

Q44: The most attractive dwellings for burglars are

Q49: Another name for relevant cost is unavoidable

Q53: Gates Company reports the following information regarding

Q108: What is operating leverage? How can the

Q149: A budget performance report that includes variances

Q155: When graphing cost-volume-profit data on a CVP