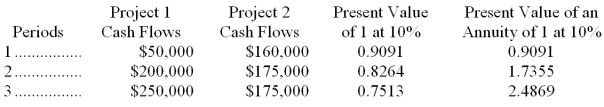

Braybar Company is deciding between two projects. Each project requires an initial investment of $350,000. The projected net cash flows for the two projects are listed below. The revenue is to be received at the end of each year. Braybar requires a 10% return on its investments. The present value of an annuity of 1 and present value of an annuity factors for 10% are presented below. Use net present value to determine which project should be pursued and explain why.

Definitions:

Purchase Price

The amount of money paid to buy goods or services.

Shipping Cost

Expenses associated with the transportation of goods from one place to another.

Net Sales

Total sales revenue minus returns, allowances for damaged or missing goods, and discounts.

Sales Discounts

Sales discounts are reductions in the price of a product or service offered by a seller to a buyer, usually to encourage prompt payment or bulk purchases.

Q18: Locking the car doors, activating an alarm,

Q28: Dunkin Company manufactures and sells a single

Q29: Hanover Hats produces specialty logo baseball caps

Q38: In the law and order movement of

Q41: The term _ refers to those situations

Q46: One similarity between criminologists and victimologists is

Q64: Thomas Company has total fixed costs of

Q79: A limitation of the internal rate of

Q116: The practice of preparing budgets for each

Q136: Identify the five steps involved in managerial