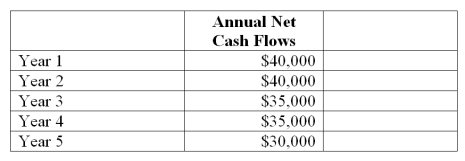

Eagle Company is considering the purchase of an asset for $100,000. It is expected to produce the following net cash flows. The cash flows occur evenly throughout each year. Compute the payback period for this investment. (Round to two decimal places.)

Definitions:

S&P 500

A stock market index tracking the performance of 500 of the largest companies listed on stock exchanges in the United States.

DJIA

Dow Jones Industrial Average, a stock market index that measures the stock performance of 30 large companies listed on stock exchanges in the United States.

Lloyds of London

A British insurance and reinsurance market, where members join together as syndicates to insure and spread risks.

FDIC

The Federal Deposit Insurance Corporation, a U.S. government agency insuring deposits in banks and thrift institutions, offering depositors protection against bank failure.

Q11: The Minnesota study conducted in the early

Q26: An advantage of the break-even time (BET)

Q34: According to the NCVS, thefts of household

Q50: The most common type of kidnapping case

Q99: A company is considering the purchase of

Q106: The difference between actual and standard cost

Q107: A company's history indicates that 20% of

Q115: Use the following data to determine the

Q132: Yamaguchi Company's break even point in units

Q157: An important tool in predicting the volume