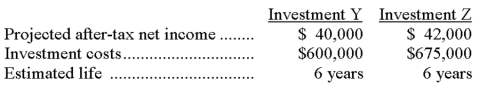

A company has a decision to make between two investment alternatives. The company requires a 10% return on investment. Predicted data is provided below:  The present value of an annuity for 6 years at 10% is 4.3553. This company uses straight-line depreciation.

The present value of an annuity for 6 years at 10% is 4.3553. This company uses straight-line depreciation.

Required:

(a) Calculate the net present value for each investment.

(b) Which investment should this company select? Explain.

Definitions:

Demand

The desire and ability of consumers to purchase goods or services at a given price over a specific period.

Multiproduct Break-even Analysis

An analysis technique used to determine the point at which total revenue equals total costs for multiple products, indicating no profit or loss.

Total Sales

The sum of all sales revenue that a company earns over a given period of time.

Discounted Value

The present value of a future amount of money or stream of income, adjusted for time and risk.

Q29: Police officers exercise a great deal of

Q43: The variation among judges in the severity

Q44: The United States Supreme Court only hears

Q44: In evaluating capital budgeting alternatives, there are

Q79: Which of the following is a benefit

Q93: In preparing a budgeted balance sheet, the

Q125: An analytical technique used by management to

Q133: Budgeting is an informal plan for future

Q135: The dollar amount of sales needed to

Q162: Landlubber Company established a standard direct materials