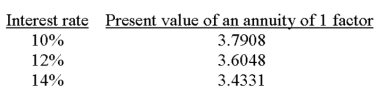

A company is considering a 5-year project. It plans to invest $60,000 now and it forecasts cash flows for each year of $16,200. The company requires a hurdle rate of 12%. Calculate the internal rate of return to determine whether it should accept this project. Selected factors for a present value of an annuity of 1 for five years are shown below:

Definitions:

Q1: Identity theft is a relatively new type

Q4: Making an offender's task more difficult through

Q28: Dunkin Company manufactures and sells a single

Q28: The merchandise purchases budget is the starting

Q30: Both criminologists and victimologists place a great

Q32: In the1980s, maximalists suspected that the true

Q37: The budget that lists the dollar amounts

Q107: At Flint Company's break-even point of 9,000

Q124: Scatter diagrams plot volume on the vertical

Q160: Which of the following is the correct