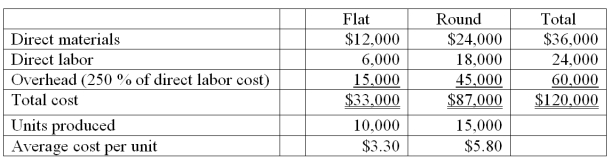

Larabee Company produces two types of product, flat and round, on the same production line. For the current period, the company reports the following data.  Larabee's controller wishes to apply activity-based costing (ABC) to allocate the $60,000 of overhead costs incurred by the two product lines to see whether cost per unit would change markedly from that reported above. She has collected the following information.

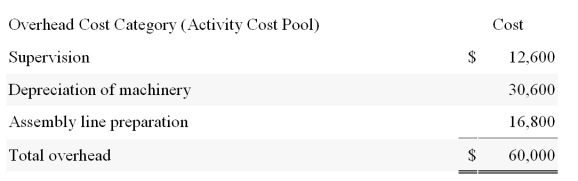

Larabee's controller wishes to apply activity-based costing (ABC) to allocate the $60,000 of overhead costs incurred by the two product lines to see whether cost per unit would change markedly from that reported above. She has collected the following information.  She has also collected the following information about the cost drivers for each category (cost pool) and the amount of each driver used by the two product lines.

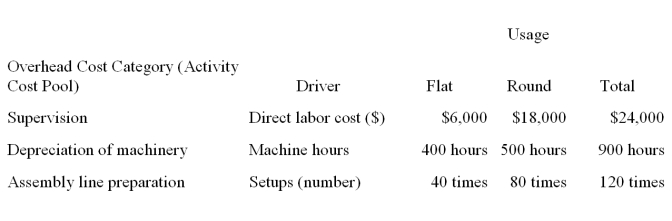

She has also collected the following information about the cost drivers for each category (cost pool) and the amount of each driver used by the two product lines.  Assign these three overhead cost pools to each of the two products using ABC. Show each overhead cost allocation by product and the total overhead allocated to each product. Determine average cost per unit for each of the two products using ABC. (Round your answer to 2 decimal places.) Which overhead cost allocation method would you recommend to the controller?

Assign these three overhead cost pools to each of the two products using ABC. Show each overhead cost allocation by product and the total overhead allocated to each product. Determine average cost per unit for each of the two products using ABC. (Round your answer to 2 decimal places.) Which overhead cost allocation method would you recommend to the controller?

Definitions:

Inflation Rate

The percentage increase in the general level of prices for goods and services over a period, reducing purchasing power.

Money Rate

Refers to the interest rate or the cost of borrowing money, which can influence economic activity by affecting consumer spending and investment.

Real Rate

The interest rate adjusted for inflation, providing a more accurate measure of the return on investment.

Inflationary Premium

The part of an asset's interest rate that compensates investors for the loss of purchasing power due to inflation.

Q8: Budgets are normally more effective when all

Q16: In a process costing accounting system, direct

Q87: Predetermined overhead rates are necessary because cost

Q103: The Palos Company expects sales for June,

Q108: A department can never be considered to

Q114: In the two-stage cost allocation, _ costs

Q127: Aniston Enterprises manufactures stylish hats for sophisticated

Q135: Refer to the following information about the

Q172: Nano Company uses a weighted average process

Q181: Winthrop Manufacturing produces a product that sells