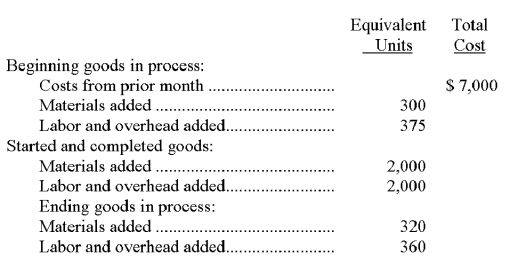

Refer to the following information about the Dipping Department of the Indiana Factory for the month of August. Indiana Factory uses the FIFO method of inventory costing.  The cost per equivalent unit of materials is $10.00, and the cost per equivalent unit of labor and overhead is $22.00. Compute the cost that should be assigned all units that were completed and transferred during August.

The cost per equivalent unit of materials is $10.00, and the cost per equivalent unit of labor and overhead is $22.00. Compute the cost that should be assigned all units that were completed and transferred during August.

Definitions:

Mitral Valve

The valve located between the left atrium and left ventricle of the heart, which regulates blood flow within the heart.

Cusps

Pointed or rounded projections on the chewing surface of teeth, important for tearing and grinding food.

Left Atrium

The upper left chamber of the heart, which receives oxygenated blood from the lungs and pumps it into the left ventricle.

Tachycardia

A condition characterized by an abnormally fast heart rate, typically defined as a heart rate of over 100 beats per minute in adults.

Q9: An approach to managing inventories and production

Q13: The difference between the unit sales price

Q48: Since the process cost summary describes the

Q57: In a process cost accounting system, direct

Q72: Standards for comparison when interpreting financial statement

Q98: An activity-based costing system usually involves a

Q122: There are only two methods to derive

Q147: The following items for Titus Company are

Q185: A _ cost contains a combination of

Q193: A variable cost changes in proportion to