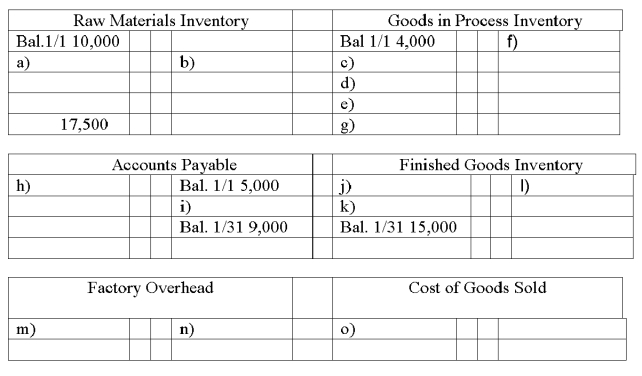

Medlar Corp. maintains a Web-based general ledger. Overhead is applied on the basis of direct labor costs. Its bookkeeper accidentally deleted most of the entries that had been recorded for January. A printout of the general ledger (in T-account form) showed the following:  A review of the prior year's financial statements, the current year's budget, and January's source documents produced the following information:

A review of the prior year's financial statements, the current year's budget, and January's source documents produced the following information:

(1) Accounts Payable is used for raw material purchases only. January purchases were $49,000.

(2) Factory overhead costs for January were $17,000 none of which is indirect materials.

(3) The January 1 balance for finished goods inventory was $10,000.

(4) There was a single job in process at January 31 with a cost of $2,000 for direct materials and $1,500 for direct labor.

(5) Total cost of goods manufactured for January was $90,000.

(6) All direct laborers earn the same rate ($13/hour). During January, 2,500 direct labor hours were worked.

(7) The predetermined overhead allocation rate is based on direct labor costs. Budgeted (expected) overhead for the year is $195,000 and budgeted (expected) direct labor is $390,000.

Fill in the missing amounts a through o above in the T-accounts above.

Definitions:

Finished Goods Inventory

The stock of completed products that are ready to be sold but are still in the company's inventory.

Direct Labor Costs

Costs associated with employees who are directly involved in the production of goods or services.

Manufacturing Overhead

All indirect costs associated with manufacturing beyond direct materials and direct labor, such as utilities, depreciation, and maintenance of equipment.

Raw Materials

Basic materials used in the production process to manufacture finished goods.

Q26: A fixed cost:<br>A) Requires the future outlay

Q27: The income level most likely to continue

Q31: One difference between financial and managerial accounting

Q67: Describe the flow of labor in a

Q77: If a department that uses process costing

Q92: A system of accounting for production operations

Q124: A report that accumulates the actual costs

Q133: A system of accounting in which the

Q149: A financial statement analysis report usually includes:<br>A)

Q155: Net income divided by net sales is