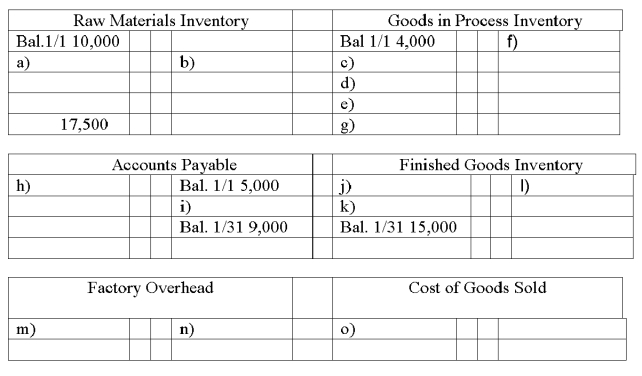

Medlar Corp. maintains a Web-based general ledger. Overhead is applied on the basis of direct labor costs. Its bookkeeper accidentally deleted most of the entries that had been recorded for January. A printout of the general ledger (in T-account form) showed the following:  A review of the prior year's financial statements, the current year's budget, and January's source documents produced the following information:

A review of the prior year's financial statements, the current year's budget, and January's source documents produced the following information:

(1) Accounts Payable is used for raw material purchases only. January purchases were $49,000.

(2) Factory overhead costs for January were $17,000 none of which is indirect materials.

(3) The January 1 balance for finished goods inventory was $10,000.

(4) There was a single job in process at January 31 with a cost of $2,000 for direct materials and $1,500 for direct labor.

(5) Total cost of goods manufactured for January was $90,000.

(6) All direct laborers earn the same rate ($13/hour). During January, 2,500 direct labor hours were worked.

(7) The predetermined overhead allocation rate is based on direct labor costs. Budgeted (expected) overhead for the year is $195,000 and budgeted (expected) direct labor is $390,000.

Fill in the missing amounts a through o above in the T-accounts above.

Definitions:

Rock Avalanche

A rapid, massive flow of rock debris down a slope, typically triggered by seismic activity or the undercutting of a mountain's base.

Rock Fall

A rock fall refers to the rapid descent of rock from a steep cliff or mountainside, often triggered by natural processes like weathering or human activities.

Earth Flow

A type of mass wasting event where soil and regolith move slowly downslope, often triggered by saturation from rainfall or melting snow.

Creep

The slow, continuous movement of material, such as soil and other weak materials, down a slope.

Q13: _ is the deliberate misuse of the

Q15: One of several ratios that reflects solvency

Q39: An example of a service department is

Q51: If one unit of Product X used

Q67: Annual cash dividends per share divided by

Q116: Using the information below for Talking Toys,

Q121: Departmental information is important and always disclosed

Q121: Evaluation of company performance can include comparison

Q141: Embark produces mulch for landscaping use. The

Q151: In horizontal analysis the percent change is