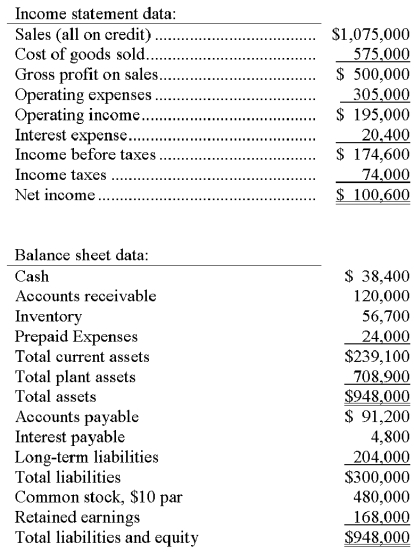

Use the following information from the current year financial statements of a company to calculate the ratios below:

(a) Current ratio.

(b) Accounts receivable turnover. (Assume the prior year's accounts receivable balance was $100,000.)

(c) Days' sales uncollected.

(d) Inventory turnover. (Assume the prior year's inventory was $50,200.)

(e) Times interest earned ratio.

(f) Return on common stockholders' equity. (Assume the prior year's common stock balance was $480,000 and the retained earnings balance was $128,000.)

(g) Earnings per share (assuming the corporation has a simple capital structure, with only common stock outstanding).

(h) Price earnings ratio. (Assume the company's stock is selling for $26 per share.)

(i) Divided yield ratio. (Assume that the company paid $1.25 per share in cash dividends.)

Definitions:

Convertible Bonds

Bonds that can be converted into a predetermined number of a company’s shares at certain times during their life, usually at the discretion of the bondholder.

Diluted Earnings Per Share

A metric that calculates the quality of earnings per share (EPS) if all convertible securities were converted into common stock, indicating the potential dilution that could occur.

Diluted EPS

Earnings per share calculated under the assumption that all convertible securities and options have been converted into additional shares, potentially lowering the EPS.

Stock Options

Contracts that give the holder the right, but not the obligation, to buy or sell a stock at a specific price before a certain date.

Q3: Liquidity and efficiency are considered to be

Q26: Three of the most common tools of

Q34: Castine reports net income of $305,000 for

Q47: A company's calendar-year financial data are shown

Q83: One of the main differences between the

Q84: If overhead applied is less than actual

Q92: A purchase of land in exchange for

Q118: What is a cost accounting system? What

Q155: Four factors come together in the manufacturing

Q156: Describe the format of the statement of