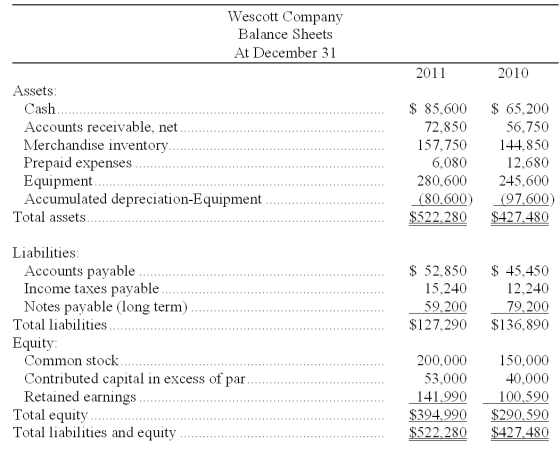

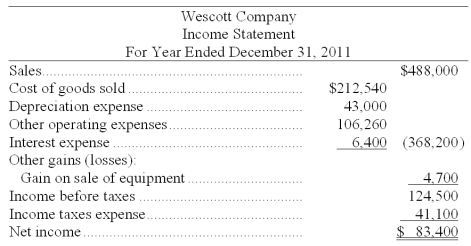

Use the following financial statements and additional information to (1) prepare a complete statement of cash flows for the year ended December 31, 2011. The cash provided or used by operating activities should be reported using the direct method, and (2) compute the company's cash flow on total assets ratio for 2011.

Additional Information

Additional Information

a. A $20,000 note payable is retired at its carrying value in exchange for cash.

b. The only changes affecting retained earnings are net income and cash dividends paid.

c. New equipment is acquired for $120,000 cash.

d. Received cash for the sale of equipment that had cost $85,000, yielding a gain of $4,700.

e. Prepaid expenses relate to Other Expenses on the income statement.

f. All purchases and sales of merchandise inventory are on credit.

Definitions:

Income From Operations

Income from operations is the profit realized from a business's core operations, excluding any earnings from investments, taxes, or special items.

Invested Assets

Resources or funds committed to ventures with the expectation of earning a return, typically includes financial investments like stocks and bonds.

Investment Turnover

The ratio of net sales to average investment, measuring how effectively investments are used to generate sales.

Income From Operations

The income earned from the core business operations of a company, excluding non-operational income and expenses.

Q12: Debt securities are recorded at cost when

Q44: Harv's Sound Systems produces speakers for movie

Q55: A _ cost has already been incurred

Q65: Identify and describe three common tools of

Q94: A high level of expected risk suggests

Q104: _ rejects the notions of "good enough"

Q133: Selected current year end financial information for

Q138: Use the following selected information from Farris,

Q155: The legal contract between the issuing corporation

Q175: Which of the following is never included