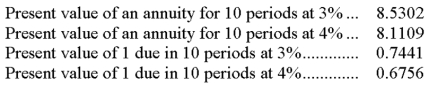

A company issues bonds with a par value of $800,000 on their issue date. The bonds mature in 5 years and pay 6% annual interest in two semiannual payments. On the issue date, the market rate of interest is 8%. Compute the price of the bonds on their issue date. The following information is taken from present value tables:

Definitions:

Mini-Dow Futures

Futures contracts based on the Dow Jones Industrial Average but with a smaller contract size, allowing for more accessible investment.

Listed Price

The official price of a commodity, security, or asset that is publicly quoted on an exchange.

Futures Contract

Financial derivatives that obligate the buyer to purchase, and the seller to sell, a specified asset at a predetermined future date and price.

Futures Contracts

Agreements to buy or sell an asset at a future date at a price agreed upon today.

Q38: On February 15, Seacroft buys 7,000 shares

Q47: Cash flows from interest received on loans

Q50: A company purchased equipment and signed a

Q82: The stockholders' equity section of a corporation's

Q105: Explain how held-to-maturity debt securities are accounted

Q108: During the closing process, each partner's withdrawals

Q151: Comprehensive income includes<br>A) Revenues and expenses reported

Q167: Book value per share:<br>A) Reflects the value

Q180: A contingent liability is a potential obligation

Q223: Book value per common share is computed