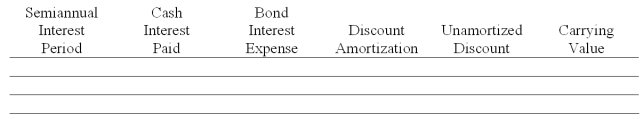

A company issued 10%, 10-year bonds with a par value of $1,000,000 on January 1, at a selling price of $885,295, to yield the buyers a 12% return. The company uses the effective interest amortization method. Interest is paid semiannually each June 30 and December 31.

(1) Prepare an amortization table for the first two payment periods using the format shown below:  (2) Prepare the journal entry to record the first semiannual interest payment.

(2) Prepare the journal entry to record the first semiannual interest payment.

Definitions:

Business Concept

An idea for a new business that includes basic information like the service or product, the target demographic, and a unique selling proposition.

Venture Capitalists

Investors who provide capital to startups and early-stage companies with high growth potential in exchange for equity.

Entrepreneurial Team

A group of individuals with diverse skills and roles who come together to found and build a startup or new venture.

Outsourced

The practice of delegating certain job functions or tasks to external contractors or firms, rather than handling them internally.

Q24: A company borrowed cash from the bank

Q25: The date the directors vote to pay

Q26: Interest payments on bonds are determined by

Q43: The debt-to-equity ratio enables financial statement users

Q105: Explain how held-to-maturity debt securities are accounted

Q126: Armstrong plans to leave the FAP Partnership.

Q128: Amounts received in advance from customers for

Q150: On March 1, a company issues bonds

Q159: Beewell's net income for the year ended

Q212: Purchasing treasury stock reduces the corporation's assets