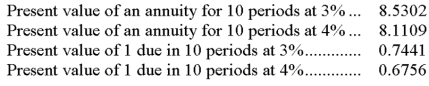

On January 1, a company issues bonds with a par value of $300,000. The bonds mature in 5 years and pay 8% annual interest each June 30 and December 31. On the issue date, the market rate of interest is 6%. Compute the price of the bonds on their issue date. The following information is taken from present value tables:

Definitions:

Cash Dividends

Distributions of a corporation's earnings to shareholders in the form of cash.

Preferred Stock

A class of ownership in a corporation that has a higher claim on its assets and earnings than common stock, usually with dividends that are paid out before those to shareholders of common stock.

Common Stock

Common stock is a type of equity ownership in a corporation, representing a claim on part of the company's profits and conferring voting rights.

No Par Common Stock

is common stock that has been issued without a par value, meaning its value is not fixed in the company’s charter but is determined by the market.

Q17: The carrying (book) value of a bond

Q43: In the accounting records of a defendant,

Q74: Juanita invested $100,000 and Jacque invested $95,000

Q82: The use of debt financing insures an

Q93: A company issued 10-year, 9% bonds, with

Q115: Summers and Winters formed a partnership on

Q118: A partnership that has at least two

Q121: A premium on common stock:<br>A) Is the

Q169: Preferred stock on which the right to

Q188: Discuss the reasons companies make investments.