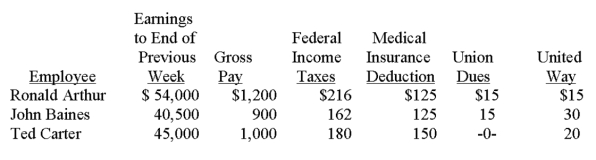

The payroll records of a company provided the following data for the weekly pay period ended December 7:  The FICA social security tax rate is 6.2% and the FICA Medicare tax rate is 1.45% on all of this week's wages paid to each employee. The federal and state unemployment tax rates are 0.8% and 5.4%, respectively, on the first $7,000 paid to each employee. Prepare the journal entries to (a) accrue the payroll and (b) record payroll taxes expense.

The FICA social security tax rate is 6.2% and the FICA Medicare tax rate is 1.45% on all of this week's wages paid to each employee. The federal and state unemployment tax rates are 0.8% and 5.4%, respectively, on the first $7,000 paid to each employee. Prepare the journal entries to (a) accrue the payroll and (b) record payroll taxes expense.

Definitions:

Direct Labor-Hours

The total hours worked by employees that can be directly attributed to the production of a specific good or service.

Manufacturing Overhead

Indirect costs related to manufacturing, not including direct materials or direct labor.

Overapplied Balance

The condition where the allocated manufacturing overhead costs exceed the actual overhead costs incurred.

Manufacturing Overhead Account

An account that tracks indirect production costs, such as utilities and rent for manufacturing facilities.

Q1: The accounting principle that requires financial statements

Q3: A company had net sales of $541,500

Q30: All of the following statements related to

Q32: _ refers to the expected proceeds from

Q55: Employers:<br>A) Pay FICA taxes equal to the

Q69: When a partner leaves a partnership, the

Q78: A company is authorized to issue 750,000

Q107: Preferred stock with a feature allowing preferred

Q144: The units-of-production method of depreciation charges a

Q188: A company has the following unadjusted account