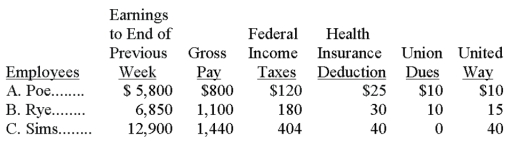

The payroll records of a company provided the following data for the current weekly pay period ended March 7.  Assume that the Social Security portion of the FICA taxes is 6.2% on the first $106,800 and the Medicare portion is 1.45% of all wages paid to each employee for this pay period. The federal and state unemployment tax rates are 0.8% and 5.4%, respectively, on the first $7,000 paid to each employee.

Assume that the Social Security portion of the FICA taxes is 6.2% on the first $106,800 and the Medicare portion is 1.45% of all wages paid to each employee for this pay period. The federal and state unemployment tax rates are 0.8% and 5.4%, respectively, on the first $7,000 paid to each employee.

Calculate the net pay for each employee.

Definitions:

Distinct Behaviours

Actions or conduct that are unique or characteristic to individuals or groups.

Proficient

Having a high degree of skill or competence in a particular activity or field.

Material

Material refers to the physical elements or resources used in the production of goods and services.

Learn

The process of acquiring knowledge, understanding, or skills through study, experience, or teaching.

Q8: A company reports the following results in

Q56: A company has $90,000 in outstanding accounts

Q62: A depreciation method that produces larger depreciation

Q75: Plant assets are:<br>A) Current assets.<br>B) Used in

Q125: A partnership recorded the following journal entry:

Q140: A corporation had 10,000 shares of $10

Q144: The units-of-production method of depreciation charges a

Q169: Each employee records the number of withholding

Q187: A machine originally had an estimated useful

Q217: Accounting for the exchange of assets depends