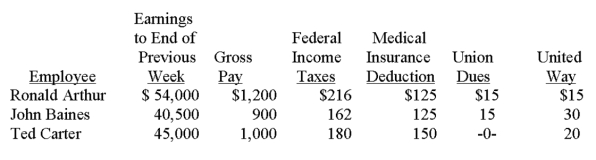

The payroll records of a company provided the following data for the weekly pay period ended December 7:  The FICA social security tax rate is 6.2% and the FICA Medicare tax rate is 1.45% on all of this week's wages paid to each employee. The federal and state unemployment tax rates are 0.8% and 5.4%, respectively, on the first $7,000 paid to each employee. Prepare the journal entries to (a) accrue the payroll and (b) record payroll taxes expense.

The FICA social security tax rate is 6.2% and the FICA Medicare tax rate is 1.45% on all of this week's wages paid to each employee. The federal and state unemployment tax rates are 0.8% and 5.4%, respectively, on the first $7,000 paid to each employee. Prepare the journal entries to (a) accrue the payroll and (b) record payroll taxes expense.

Definitions:

Markowitz Model

A portfolio optimization theory that employs diversification to maximize returns for a given level of risk through quantitative analysis.

NYSE

The New York Stock Exchange, a leading global platform for buying, selling, and trading stocks and securities.

Single-Index Model

A simplified way to estimate the return of a stock using the performance of a single market index as the primary factor.

Macro Risk

The potential for financial loss in markets that arises from adverse changes in macroeconomic conditions.

Q2: At December 31, Warren Company reports the

Q3: A company had net sales of $541,500

Q17: The Discount on Common Stock account reflects:<br>A)

Q33: Notes receivable are classified as current liabilities.

Q44: Under IFRS, the term provision:<br>A) Refers to

Q127: Federal depository banks are authorized to accept

Q151: Salta Company installs a manufacturing machine in

Q155: The three main factors in computing depreciation

Q159: _ are banks authorized to accept deposits

Q174: A bank reconciliation explains any differences between