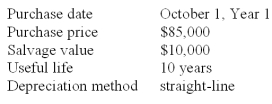

The following information is available on a depreciable asset owned by First Bank & Trust:  The asset's book value is $70,000 on October 1, Year 3. On that date, management determines that the asset's salvage value should be $5,000 rather than the original estimate of $10,000. Based on this information, the amount of depreciation expense the company should recognize during the last three months of Year 3 would be:

The asset's book value is $70,000 on October 1, Year 3. On that date, management determines that the asset's salvage value should be $5,000 rather than the original estimate of $10,000. Based on this information, the amount of depreciation expense the company should recognize during the last three months of Year 3 would be:

Definitions:

Goodwill Amortization

The systematic reduction of the recorded value of goodwill on a company's financial statements over time, although often goodwill is not amortized under current accounting standards but is instead tested annually for impairment.

Reporting Purposes

The reasons or objectives behind collecting and presenting financial or operational information, often dictated by regulatory requirements, investor relations, or internal management needs.

Tax Purposes

Refers to the reasons or intent behind financial or accounting decisions, calculations, or classifications that impact tax liability.

Net Operating Loss Carryforward

A tax provision that allows a company to utilize a taxable loss in one period to offset taxable profits in future periods.

Q21: The voucher system of control:<br>A) Is a

Q33: Admitting a partner by accepting assets is

Q56: A company has $90,000 in outstanding accounts

Q84: A _ is an unincorporated association of

Q86: Carmel Company acquires a mineral deposit at

Q91: Control of cash disbursements is important for

Q109: Inadequacy refers to the insufficient capacity of

Q143: A company declared a $0.55 per share

Q186: At December 31 of the current year,

Q190: A remittance advice is:<br>A) An explanation for