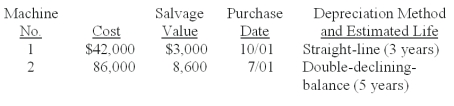

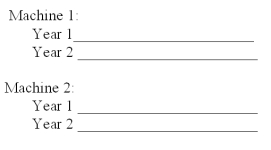

A company's property records revealed the following information about its plant assets:  Calculate the depreciation expense for each machine for the year ended December 31 for Year 1, and for the year ended December 31 for Year 2.

Calculate the depreciation expense for each machine for the year ended December 31 for Year 1, and for the year ended December 31 for Year 2.

Definitions:

Par Value

The nominal or face value of a stock or bond as stated by the issuing company, which may differ from its market value.

Amortized

The process of gradually writing off the initial cost of an asset over a period, typically the asset's useful life.

Retirement

The process of leaving one's job or career and ceasing to work, typically due to age.

Premium on Bonds Payable

The amount by which the selling price of a bond exceeds its face value, representing an additional cost to the issuer.

Q8: A company made a bank deposit on

Q21: A company's income before interest expense and

Q22: The amount due on the maturity date

Q28: A company needed a new building. It

Q40: A copyright gives its owner the exclusive

Q52: The formula for computing annual straight-line depreciation

Q84: _ are probable future payments of assets

Q95: All of the following statements regarding valuation

Q123: The BlueFin Partnership agrees to dissolve. The

Q160: Plant assets are:<br>A) Tangible assets used in