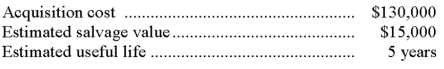

On April 1, Year 1, SAS Corp. purchased and placed in service a plant asset. The following information is available regarding the plant asset:  Make the necessary adjusting journal entries at December 31, Year 1, and December 31, Year 2 to record depreciation for each year under the following depreciation methods:

Make the necessary adjusting journal entries at December 31, Year 1, and December 31, Year 2 to record depreciation for each year under the following depreciation methods:

a. Straight-line.

b. Double-declining-balance.

Definitions:

Visual Basic Window

A development environment within various Microsoft products, such as Excel or Access, used for writing, testing, and running Visual Basic (VB) code.

Logical Conditions

Criteria or expressions that evaluate to true or false, used in programming and database queries to make decisions based on specific conditions.

If…Then Logic

A basic programming construct that executes a block of code if a specified condition is true.

Execute Statements

The process of running commands or scripts in a database or programming environment to perform operations like data manipulation or schema changes.

Q12: A short-term note payable:<br>A) Is a written

Q31: Following are seven items a through g

Q63: MixRecording Studios purchased $7,800 in electronic components

Q75: A _ means that at least one

Q110: FICA taxes include:<br>A) Social Security taxes.<br>B) Charitable

Q123: _ refers to the expected proceeds from

Q133: The person who signs a note receivable

Q135: A company borrowed $10,000 by signing a

Q153: On January 31, Hale Company's payroll register

Q212: The relevant factor(s) in computing depreciation include:<br>A)