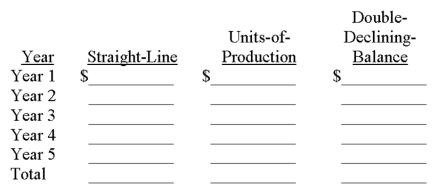

A company purchased a machine on January 1 of the current year for $750,000. Calculate the annual depreciation expense for each year of the machine's life (estimated at 5 years or 20,000 hours, with a salvage value of $75,000). During the machine's 5-year life its hourly usage was: 3,000; 4,000; 5,000; 5,000; and 3,000 hours.

Definitions:

Non-Member Manager

A manager in a limited liability company (LLC) who is not an owner or member of the LLC.

Personal Liability

the legal responsibility of an individual to settle debts or fulfill obligations from their own assets.

Fraud

An intentional deception made for personal gain or to damage another individual.

Masonry LLC

A limited liability company specializing in the trade of working with bricks, stone, concrete, and other similar construction materials.

Q17: The maturity date of a note receivable:<br>A)

Q60: Vacation benefits are a type of _

Q77: Electronic funds transfer (EFT) is the electronic

Q87: Most companies use batch processing instead of

Q91: The flexibility principle prescribes that an accounting

Q98: The employer should record payroll deductions as:<br>A)

Q108: Dylan Lauren of Dylan's Candy Bar knew

Q114: Recording employee payroll deductions may involve:<br>A) Liabilities

Q132: An employer has an employee benefit package

Q134: The total cost of an asset less