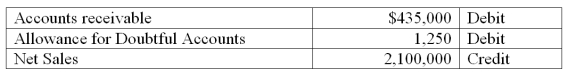

A company used the percent of sales method to determine its bad debts expense. At the end of the current year, the company's unadjusted trial balance reported the following selected amounts:  All sales are made on credit. Based on past experience, the company estimates 1% of credit sales to be uncollectible. What adjusting entry should the company make at the end of the current year to record its estimated bad debts expense?

All sales are made on credit. Based on past experience, the company estimates 1% of credit sales to be uncollectible. What adjusting entry should the company make at the end of the current year to record its estimated bad debts expense?

Definitions:

Covenants

Legal agreements or conditions included in contracts such as bonds or loans that dictate certain actions the issuer or borrower must perform or avoid.

Dividends

Distributions of a portion of a company's earnings decided by the board of directors to its shareholders.

Retained Earnings

The portion of a company's profits that is not distributed to shareholders as dividends but is kept back in the business for reinvestment or to pay off debt.

Equity Financing

The method of raising capital by selling company shares to investors; in return, investors receive ownership interests in the company.

Q19: A company borrowed $60,000 by signing a

Q43: Input devices include:<br>A) Bar-code readers.<br>B) Printers.<br>C) Software.<br>D)

Q49: The segment return on assets:<br>A) Can only

Q60: The following data are taken from the

Q65: The _ method of accounting for bad

Q78: An estimated liability:<br>A) Is an unknown liability

Q80: Companies with many employees often use a

Q126: The straight-line depreciation method and the double-declining-balance

Q129: _ are the means to take information

Q158: ABC Co. sold $80,000 of accounts receivable