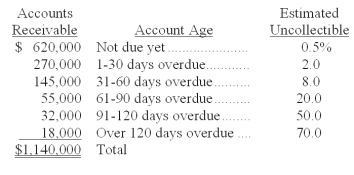

A company uses the aging of accounts receivable method to estimate its bad debts expense. On December 31 of the current year an aging analysis of accounts receivable revealed the following:  Required:

Required:

a. Calculate the amount of the Allowance for Doubtful Accounts that should be reported on the current year-end balance sheet.

b. Calculate the amount of the Bad Debts Expense that should be reported on the current year's income statement, assuming that the balance of the Allowance for Doubtful Accounts on January 1 of the current year was $44,000 and that accounts receivable written off during the current year totaled $49,200.

c. Prepare the adjusting entry to record bad debts expense on December 31 of the current year.

d. Show how Accounts Receivable will appear on the current year-end balance sheet as of December 31.

Definitions:

Variable Costing

A costing method that includes only variable manufacturing costs (direct materials, direct labor, and variable manufacturing overhead) in product costs and treats fixed manufacturing overhead as a period expense.

Generally Accepted Accounting Principles

A set of accounting standards, guidelines, and procedures used in the preparation of financial statements to ensure consistency and transparency.

Stockholders

Individuals or entities that own shares in a corporation, giving them various rights like voting on company matters and receiving dividends.

Cost-Volume-Profit Graph

A visual representation that shows how changes in cost, volume, and profit affect a business.

Q4: Describe the accounting for natural resources, including

Q30: All of the following statements related to

Q46: On August 17, at the end of

Q70: Discuss how the principles of internal control

Q84: A company had the following purchases during

Q129: A voucher system is a series of

Q137: _ are amounts owed by customers from

Q143: A company had $43 missing from petty

Q148: Calco accepts all major bank credit cards,

Q153: On January 31, Hale Company's payroll register