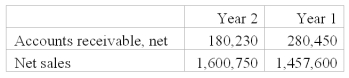

The following data are taken from the comparative balance sheets of Gayle Company. Compute and interpret its accounts receivable turnover for Year 2. Competitors average a turnover of 7.5. How is the company doing in relation to its competitors?

Definitions:

Straight-Line Depreciation

A method of allocating the cost of a tangible asset over its useful life uniformly.

Net Advantage to Leasing

The total financial benefits of leasing an asset, compared to purchasing it, taking into account all costs and savings.

Lease Payments

Regular payments made by a lessee to a lessor for the use of a leased asset.

CCA Rate

The percentage rate used in Canada to calculate capital cost allowance, which is a deductible expense for tax purposes on the depreciation of assets.

Q27: Identify and discuss the factors involved in

Q34: Accounts receivable information for specific customers is

Q73: A check involves three parties:<br>A) The writer,

Q84: A company had the following purchases during

Q93: The Woodview Company uses a sales journal,

Q96: Timmons Company had a January 1, balance

Q99: Assume that a company uses a sales

Q104: The Connecting Company uses the percent of

Q118: Receivables can be used to obtain cash

Q204: Goodwill:<br>A) Is not amortized, but is tested