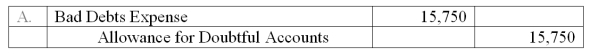

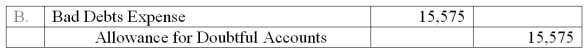

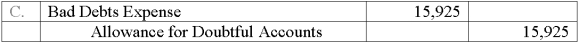

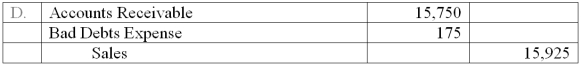

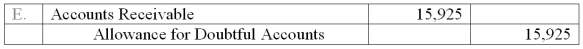

A company ages its accounts receivables to determine its end of period adjustment for bad debts. At the end of the current year, management estimated that $15,750 of the accounts receivable balance would be uncollectible. Prior to any year-end adjustments, the Allowance for Doubtful Accounts had a debit balance of $175. What adjusting entry should the company make at the end of the current year to record its estimated bad debts expense?

Definitions:

Price Elasticity

A measure of how much the quantity demanded of a good responds to a change in the price of that good, indicative of the good's necessity or luxury status.

Excise Tax

A tax applied specifically on the sale of certain goods, services, or activities, which is often included in the price of the product.

Elasticity of Labor Supply

The responsiveness of the quantity of labor that workers are willing and able to provide to a change in the wage rate.

Wages

Payments made to workers for their labor, typically calculated on an hourly, daily, or piecework basis.

Q14: Define liabilities and explain the difference between

Q37: Describe the banking activities that promote the

Q60: The steps to reconcile the balance of

Q71: The impact of technology on internal controls

Q109: When a company holds a large number

Q144: Williams Company began business on May 1.

Q179: Installment accounts receivable are classified as current

Q206: Amortization is the process of allocating the

Q210: Salta Company installs a manufacturing machine in

Q212: The relevant factor(s) in computing depreciation include:<br>A)