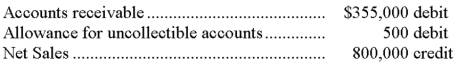

A company uses the percent of sales method to determine its bad debts expense. At the end of the current year, the company's unadjusted trial balance reported the following selected amounts:  All sales are made on credit. Based on past experience, the company estimates 0.6% of credit sales to be uncollectible. What adjusting entry should the company make at the end of the current year to record its estimated bad debts expense?

All sales are made on credit. Based on past experience, the company estimates 0.6% of credit sales to be uncollectible. What adjusting entry should the company make at the end of the current year to record its estimated bad debts expense?

Definitions:

Managing Emotions

The ability to recognize, understand, and appropriately express one's emotions in a way that promotes emotional well-being and interpersonal relationships.

Relationship Management

The strategy and processes for managing interactions and relationships with customers, clients, and stakeholders to build trust, loyalty, and long-term engagement.

Personalized Power Motive

A personal drive to control or influence others, often for self-serving purposes rather than communal goals.

Resolving Disputes

The process of finding solutions to disagreements or conflicts between parties through negotiation, mediation, or formal procedures.

Q3: A company's income before interest expense and

Q20: On June 1, Martin Company signed a

Q62: Installment accounts receivable is another name for

Q66: A company purchased a cash register on

Q91: The flexibility principle prescribes that an accounting

Q102: The Sun Company completed the following sales

Q115: List the five basic principles of accounting

Q129: A company had net sales of $600,000,

Q152: Unearned revenues are amounts received _ for

Q198: A company sold for $40,000 cash a