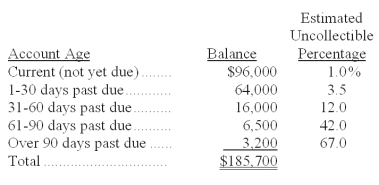

A company has the following unadjusted account balances at December 31, of the current year; Accounts Receivable of $185,700 and Allowance for Doubtful Accounts of $1,600 (credit balance). The company uses the aging of accounts receivable to estimate its bad debts. The following aging schedule reflects its accounts receivable at the current year-end:  1. Calculate the amount of the Allowance for Doubtful Accounts that should appear on the December 31, of the current year, balance sheet.

1. Calculate the amount of the Allowance for Doubtful Accounts that should appear on the December 31, of the current year, balance sheet.

2. Prepare the adjusting journal entry to record bad debts expense for the current year.

Definitions:

Prospectively

Prospectively means looking forward or considering future events, often used in accounting in terms of adopting new policies for future transactions.

LIFO Reserve

The difference between the cost of inventory calculated under the Last In, First Out (LIFO) method and another inventory costing method like First In, First Out (FIFO).

Deferred Taxes

Taxes that are owed but not yet paid, arising from temporary differences between accounting and tax treatments of income and expenses.

Retrospective Adjustment

A change applied to the accounting records of prior periods to correct an error or implement a change in accounting principle.

Q9: A company's payroll information for the month

Q27: The cost of an inventory item includes

Q35: All of the following statements regarding accounting

Q54: The matching principle is used by some

Q74: A company uses the aging of accounts

Q94: A company borrowed $50,000 from a bank

Q102: Marbel had $2,816 million in sales and

Q107: Natural resources are assets that include standing

Q124: If the credit balance of the Allowance

Q131: A company purchased a heating system on